Starting from:

$0

Home

Historical Events

2007/2008 Financial Crisis: Financial Industry & Government E-Mails - Download

2007/2008 Financial Crisis: Financial Industry & Government E-Mails - Download

2007/2008 Financial Crisis: Financial Industry & Government Private E-Mails

A collection of 806 pages of E-Mails collected by the Financial Crisis Inquiry Commission related to its investigation of the financial crisis of circa 2007. The E-Mails date from 2001 to 2011. In the wake of the most significant financial crisis since the Great Depression, President Barack Obama signed into law the Fraud Enforcement and Recovery Act (Public Law 111-21) that established the Financial Crisis Inquiry Commission to “examine the causes, domestic and global, of the current financial and economic crisis in the United States.” The Commission used the authority it was given to issue subpoenas to compel the production of documents, but in the vast majority of instances, companies and individuals voluntarily cooperated with the inquiry.

These documents were part of its inquiry into institutions that included American International Group (AIG), Bear Stearns, Citigroup, Countrywide Financial, Fannie Mae, Goldman Sachs, Lehman Brothers, Merrill Lynch, Moody’s, and Wachovia. Public institutions covered include the Federal Deposit Insurance Corporation, the Federal Reserve Board, the Federal Reserve Bank of New York, the Department of Housing and Urban Development, the Office of the Comptroller of the Currency, the Office of Federal Housing Enterprise Oversight (and its successor, the Federal Housing Finance Agency), the Office of Thrift Supervision, the Securities and Exchange Commission, and the Treasury Department.

Highlights from this collection

September 9, 2004 - E-mail from Countrywide Financial chairman of the board and chief executive officer Angelo Mozilo to Stan Kurland and Keith McLaughlin, subject: Subprime Residuals

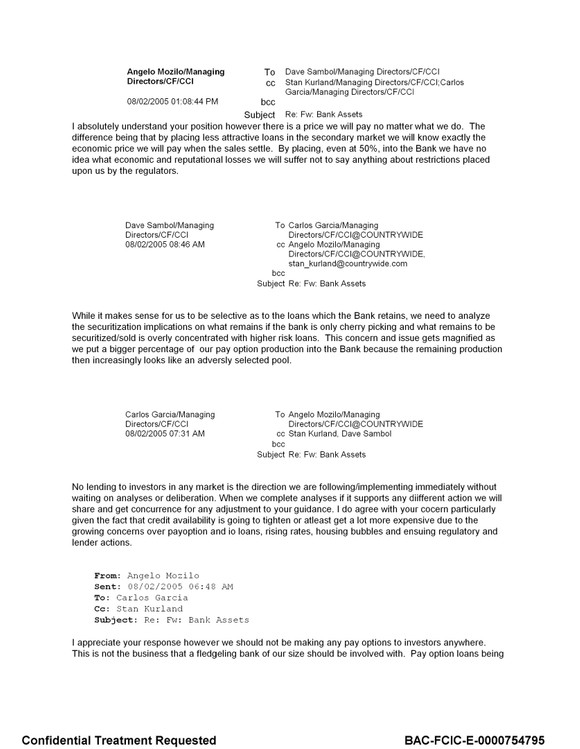

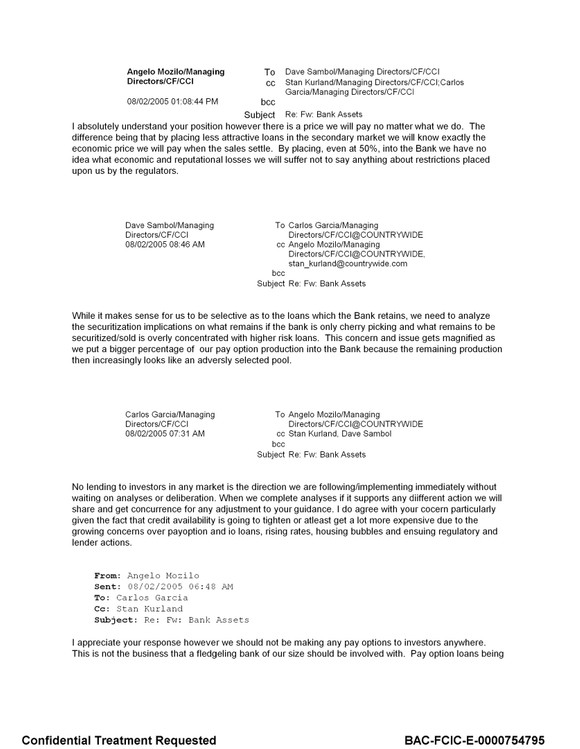

August 2, 2005 - E-mail from Countrywide Financial chairman of the board and chief executive officer Angelo Mozilo to senior management

Mozilo emailed senior management that a section of their loans could bring “financial and reputational catastrophe.” Countrywide should not market them to investors, he insisted. “Pay option loans being used by investors is a pure commercial spec[ulation] loan and not the traditional home loan that we have successfully managed throughout our history,” Mozilo wrote to Carlos Garcia, CEO of Countrywide Bank. Speculative investors “should go to Chase or Wells not us. It is also important for you and your team to understand from my point of view that there is nothing intrinsically wrong with pay options loans themselves, the problem is the quality of borrowers who are being offered the product and the abuse by third party originators. . . . [I]f you are unable to find sufficient product then slow down the growth of the Bank for the time being.”

February 28, 2006 - E-Mail from AIG Managing Director of Financial Products Gene Park to AIG Financial Products officer Joe Cassano, Subject: CDO of ABS Approach Going Forward - Message to the

Dealer Community

This e-mail marks AIG decision to stop writing credit default swaps on super-senior tranches of CDO'S.

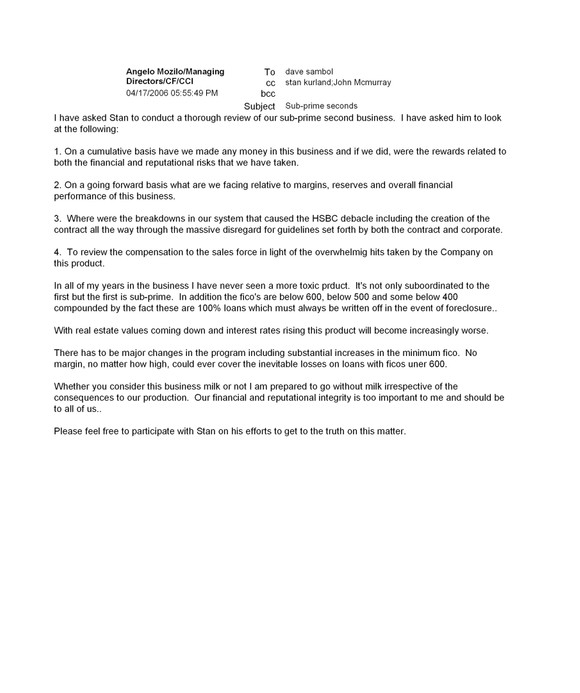

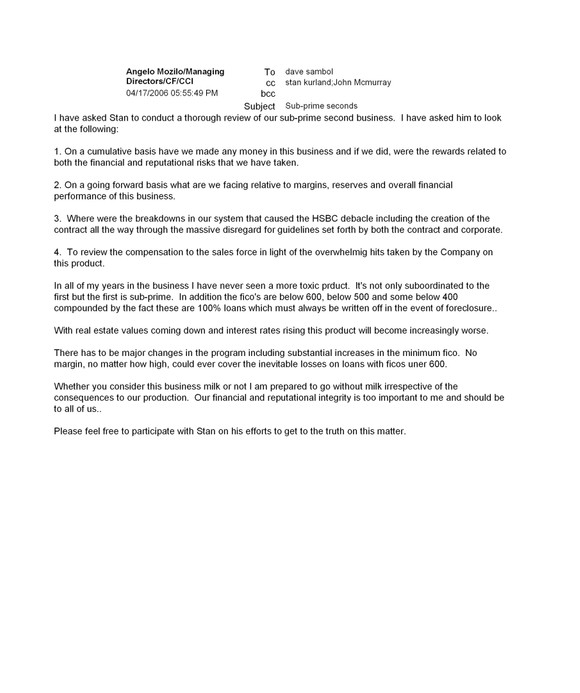

April 17, 2006 - Angelo Mozilo, email to David Sambol, April 17, 2006, subject: sub-prime seconds.

Countrywide’s Mozilo to Countrywide’s President and COO David Sambol describes one of the loan products his firm was originating.“In all my years in the business I have never seen a more toxic [product],” he wrote in an internal email.

March 30, 2007 - E-mail from Bear Stearns Senior Managing Director Matthew Tannin to Bear Stearns credit analyst Steven Van Solkema.

April 22, 2007 - E-mail from Bear Stearns Senior Managing Director Matthew Tannin to Bear Stearns hedge fund manager Ralph Cioffi.

In the days leading up to the Bear Stearns meltdown, Treasury undersecretary Robert Steel informed Fannie Mae CEO Daniel Mudd that he had "encouraging" conversations with Senator Richard Shelby, the ranking member of the Senate Committee on Banking, Housing, and Urban Affairs, and Representative Barney Frank, chairman of the House Financial Services Committee, about the possibility of government- sponsored enterprise (GSE) reform legislation and capital relief for the GSEs. Steel intended to speak with Senate Banking Committee Chairman Christopher Dodd. Mudd was confident that the government desperately needed the GSEs to back up the mortgage market, so Mudd proposed an "easier trade." Mudd proposed that if regulators would eliminate the surcharge, Fannie Mae would agree to raise new capital. Also in this March 7, 2008 email to Fannie chief business officer

Robert Levin, Mudd suggested that the 30% capital surplus requirement might be reduced without any trade: "It's a time game.. whether they need us more... or if we hit the capital wall first. Be cool."

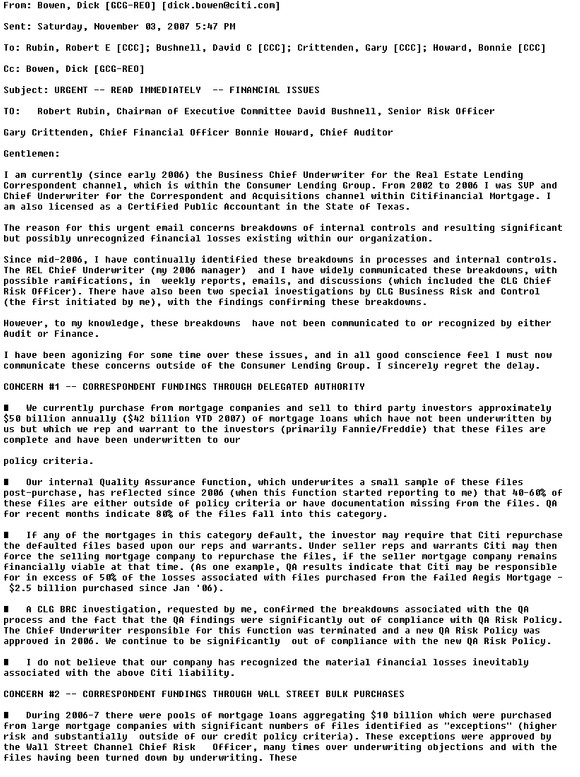

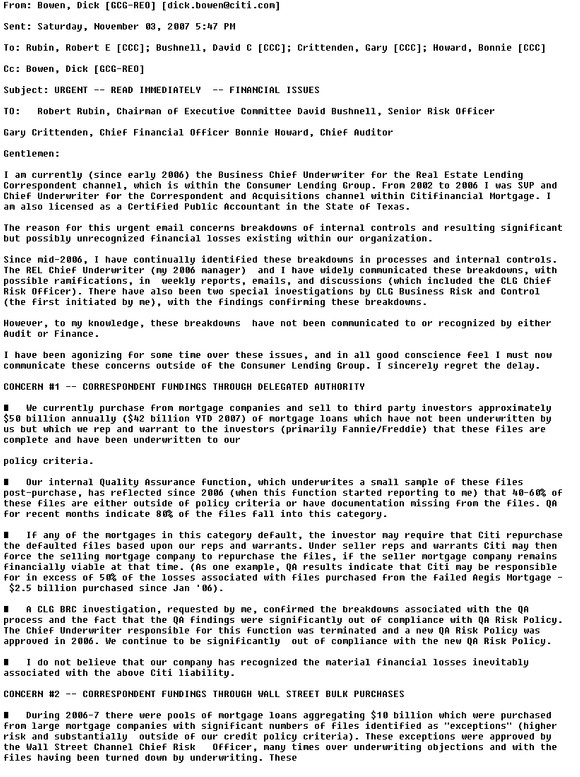

November 3, 2007 - E-mail from Dick Bowen to Citigroup Chairman Robert Rubin, and other top Citigroup executives, concerning unrecognized financial loses.

Richard Bowen was chief business underwriter at Citigroup. He oversaw loan quality for over $90 billion a year of mortgages underwritten and purchased by CitiFinancial. Bowen says that in June 2006 he came to see that up to sixty-percent of the loans that were being purchased by CitiFinancial had seriously fell short of Citi's guidelines. Citi could be forced to buy back loans it sold to other institutions if the borrowers defaulted.

In an interview with staff members of the Financial Crisis Inquiry Commission, Bowen said that he attempted to inform his superiors of the danger through email, weekly reports, committee presentations, and discussions. Unsatisfied with the actions taken, he went to the highest level at Citigroup with the e-mail below. In an e-mail sent to Robert Rubin with the subject "URGENT—READ IMMEDIATELY," Bowen spelled out the trouble he discovered.

June 12, 2008 - E-mail from Thomas Fontana, head of risk management in Citigroup’s global financial institutions group, to Citigroup's Christopher M. Foskett, concerning Lehman.

September 9, 2008 - E-mail from Treasury Chief of Staff Jim Wilkinson to Michelle Davis, assistant secretary for public affairs at Treasury, expressing his distaste for government assistance to Lehman.

By September 8th, 2008 the fact that Lehman was moribund became even clearer. The New Federal Reserve Bank was informed that Lehman’s tri-party repo exposure was at roughly $200 billion. Before its collapse Bear Stearns’s exposure had been at most $80 billion. Lehman was working on an investment by Korea Development Bank to raise capital.

On September 9th news broke that there would be no investment from Korea Development Bank. Lehman shares fell by 55 percent.

Treasury Department Chief of Staff Jim Wilkinson at 5:20 p.m emailed Michelle Davis, the assistant secretary for public affairs at Treasury, to express his distaste for government assistance: "We need to talk… I just can't stomach us bailing out lehman… Will be horrible in the press don't u think."

September 11, 2008 - Federal Reserve Bank E-mail from Susan McCabe to William Dudley, Gustavo Suarez and Chris Burke, "this is shaping up as going to be a rough day."

September 11, 2008 is marked as the day by many that the Lehman Brothers bankruptcy was set in stone.

On Thursday September 11, an email time-stamped 8:26 a.m. from Susan Mc-Cabe, a Goldman Sachs executive, to William Dudley, Gustavo Suarez and Chris Burke at the Federal Reserve Board set the tone for the day: "It is not pretty, This is getting pretty scary and ugly again.... They [Lehman] have much.

A collection of 806 pages of E-Mails collected by the Financial Crisis Inquiry Commission related to its investigation of the financial crisis of circa 2007. The E-Mails date from 2001 to 2011. In the wake of the most significant financial crisis since the Great Depression, President Barack Obama signed into law the Fraud Enforcement and Recovery Act (Public Law 111-21) that established the Financial Crisis Inquiry Commission to “examine the causes, domestic and global, of the current financial and economic crisis in the United States.” The Commission used the authority it was given to issue subpoenas to compel the production of documents, but in the vast majority of instances, companies and individuals voluntarily cooperated with the inquiry.

These documents were part of its inquiry into institutions that included American International Group (AIG), Bear Stearns, Citigroup, Countrywide Financial, Fannie Mae, Goldman Sachs, Lehman Brothers, Merrill Lynch, Moody’s, and Wachovia. Public institutions covered include the Federal Deposit Insurance Corporation, the Federal Reserve Board, the Federal Reserve Bank of New York, the Department of Housing and Urban Development, the Office of the Comptroller of the Currency, the Office of Federal Housing Enterprise Oversight (and its successor, the Federal Housing Finance Agency), the Office of Thrift Supervision, the Securities and Exchange Commission, and the Treasury Department.

Highlights from this collection

September 9, 2004 - E-mail from Countrywide Financial chairman of the board and chief executive officer Angelo Mozilo to Stan Kurland and Keith McLaughlin, subject: Subprime Residuals

August 2, 2005 - E-mail from Countrywide Financial chairman of the board and chief executive officer Angelo Mozilo to senior management

Mozilo emailed senior management that a section of their loans could bring “financial and reputational catastrophe.” Countrywide should not market them to investors, he insisted. “Pay option loans being used by investors is a pure commercial spec[ulation] loan and not the traditional home loan that we have successfully managed throughout our history,” Mozilo wrote to Carlos Garcia, CEO of Countrywide Bank. Speculative investors “should go to Chase or Wells not us. It is also important for you and your team to understand from my point of view that there is nothing intrinsically wrong with pay options loans themselves, the problem is the quality of borrowers who are being offered the product and the abuse by third party originators. . . . [I]f you are unable to find sufficient product then slow down the growth of the Bank for the time being.”

February 28, 2006 - E-Mail from AIG Managing Director of Financial Products Gene Park to AIG Financial Products officer Joe Cassano, Subject: CDO of ABS Approach Going Forward - Message to the

Dealer Community

This e-mail marks AIG decision to stop writing credit default swaps on super-senior tranches of CDO'S.

April 17, 2006 - Angelo Mozilo, email to David Sambol, April 17, 2006, subject: sub-prime seconds.

Countrywide’s Mozilo to Countrywide’s President and COO David Sambol describes one of the loan products his firm was originating.“In all my years in the business I have never seen a more toxic [product],” he wrote in an internal email.

March 30, 2007 - E-mail from Bear Stearns Senior Managing Director Matthew Tannin to Bear Stearns credit analyst Steven Van Solkema.

April 22, 2007 - E-mail from Bear Stearns Senior Managing Director Matthew Tannin to Bear Stearns hedge fund manager Ralph Cioffi.

In the days leading up to the Bear Stearns meltdown, Treasury undersecretary Robert Steel informed Fannie Mae CEO Daniel Mudd that he had "encouraging" conversations with Senator Richard Shelby, the ranking member of the Senate Committee on Banking, Housing, and Urban Affairs, and Representative Barney Frank, chairman of the House Financial Services Committee, about the possibility of government- sponsored enterprise (GSE) reform legislation and capital relief for the GSEs. Steel intended to speak with Senate Banking Committee Chairman Christopher Dodd. Mudd was confident that the government desperately needed the GSEs to back up the mortgage market, so Mudd proposed an "easier trade." Mudd proposed that if regulators would eliminate the surcharge, Fannie Mae would agree to raise new capital. Also in this March 7, 2008 email to Fannie chief business officer

Robert Levin, Mudd suggested that the 30% capital surplus requirement might be reduced without any trade: "It's a time game.. whether they need us more... or if we hit the capital wall first. Be cool."

November 3, 2007 - E-mail from Dick Bowen to Citigroup Chairman Robert Rubin, and other top Citigroup executives, concerning unrecognized financial loses.

Richard Bowen was chief business underwriter at Citigroup. He oversaw loan quality for over $90 billion a year of mortgages underwritten and purchased by CitiFinancial. Bowen says that in June 2006 he came to see that up to sixty-percent of the loans that were being purchased by CitiFinancial had seriously fell short of Citi's guidelines. Citi could be forced to buy back loans it sold to other institutions if the borrowers defaulted.

In an interview with staff members of the Financial Crisis Inquiry Commission, Bowen said that he attempted to inform his superiors of the danger through email, weekly reports, committee presentations, and discussions. Unsatisfied with the actions taken, he went to the highest level at Citigroup with the e-mail below. In an e-mail sent to Robert Rubin with the subject "URGENT—READ IMMEDIATELY," Bowen spelled out the trouble he discovered.

June 12, 2008 - E-mail from Thomas Fontana, head of risk management in Citigroup’s global financial institutions group, to Citigroup's Christopher M. Foskett, concerning Lehman.

September 9, 2008 - E-mail from Treasury Chief of Staff Jim Wilkinson to Michelle Davis, assistant secretary for public affairs at Treasury, expressing his distaste for government assistance to Lehman.

By September 8th, 2008 the fact that Lehman was moribund became even clearer. The New Federal Reserve Bank was informed that Lehman’s tri-party repo exposure was at roughly $200 billion. Before its collapse Bear Stearns’s exposure had been at most $80 billion. Lehman was working on an investment by Korea Development Bank to raise capital.

On September 9th news broke that there would be no investment from Korea Development Bank. Lehman shares fell by 55 percent.

Treasury Department Chief of Staff Jim Wilkinson at 5:20 p.m emailed Michelle Davis, the assistant secretary for public affairs at Treasury, to express his distaste for government assistance: "We need to talk… I just can't stomach us bailing out lehman… Will be horrible in the press don't u think."

September 11, 2008 - Federal Reserve Bank E-mail from Susan McCabe to William Dudley, Gustavo Suarez and Chris Burke, "this is shaping up as going to be a rough day."

September 11, 2008 is marked as the day by many that the Lehman Brothers bankruptcy was set in stone.

On Thursday September 11, an email time-stamped 8:26 a.m. from Susan Mc-Cabe, a Goldman Sachs executive, to William Dudley, Gustavo Suarez and Chris Burke at the Federal Reserve Board set the tone for the day: "It is not pretty, This is getting pretty scary and ugly again.... They [Lehman] have much.

2 files (45.0MB)